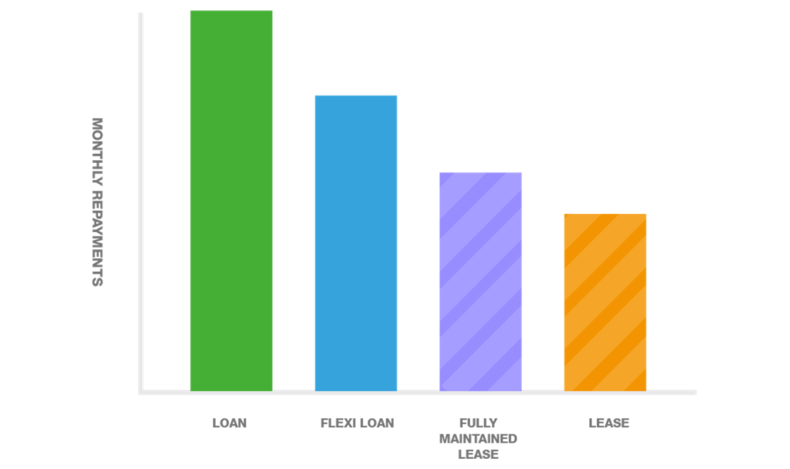

As a business, there are a number of advantages to financing your company fleet. It allows you to protect the capital in your business, leaving it free to invest into other assets, encourages vehicle expenses to be part of cashflow compared to capital expenditure, and in most cases comes with a number of taxation benefits. Overall the benefits are clear from a business side, but with the number of finance and lease options available, what’s right for your business? We’ve put together the below helpful guides to step you through the process.