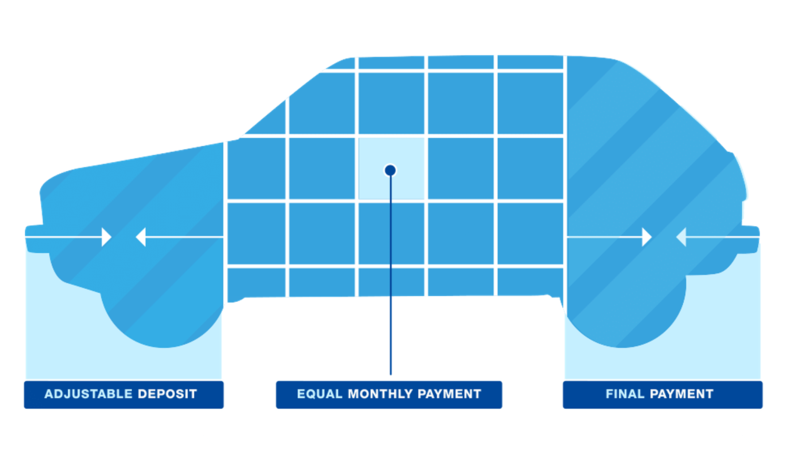

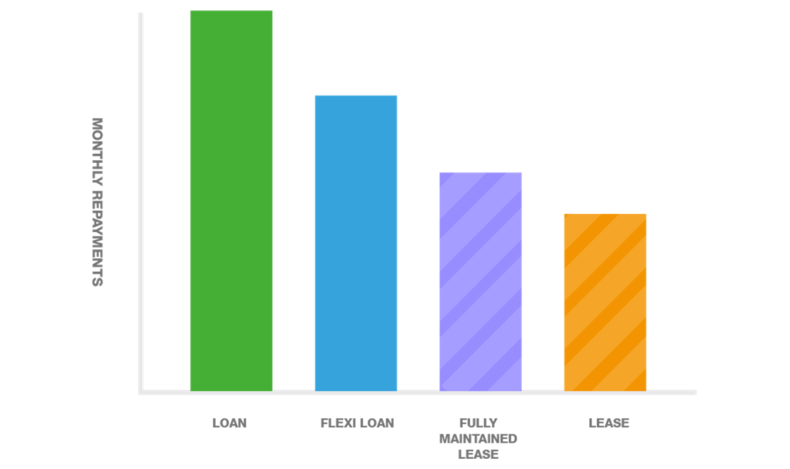

Our Flexi Loan product is designed for those who want more flexibility with their cash flow and the ability to keep their monthly repayments low. This means you often are able to get a higher specification model vehicle while still staying within your monthly budget. Find out more below about the benefits of this product and if it may be right for you.

Our standard lease product covers the lease of a new Honda excluding servicing and maintenance costs.

FIND OUT MORE