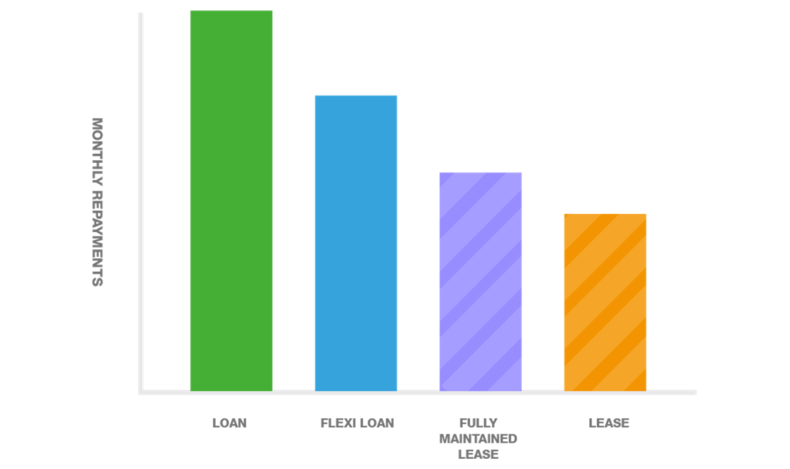

Our Loan product is a process many customers will be familiar with if they have previously used finance. Our simple and easy to follow process means we can have your loan sorted quickly – in many cases even on the same day. With our competitive finance rates, we offer excellent solutions for you as our client. Find out more below about the benefits of choosing the Loan Product from Honda Financial Services.

Our standard lease product covers the lease of a new Honda excluding servicing and maintenance costs.

FIND OUT MORE